Financing Your Project

“Spread the cost of your project with fixed monthly payments to suit your budget”

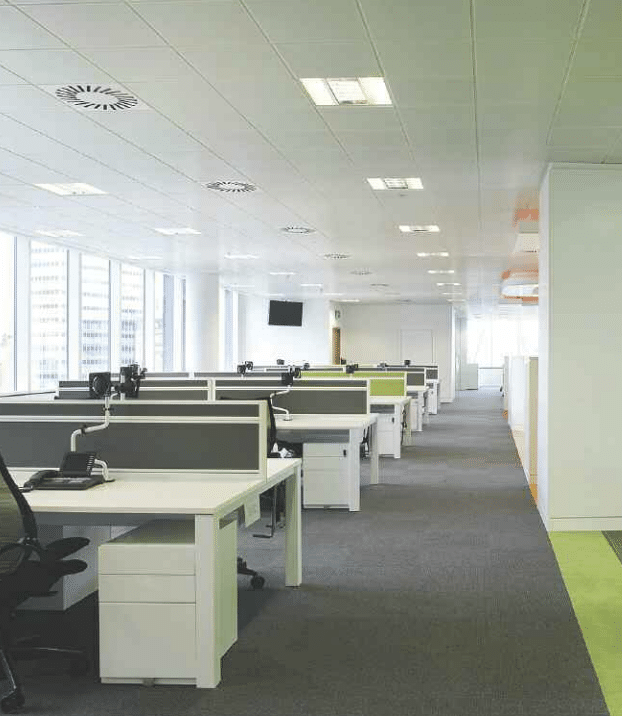

Get in touchAsset finance is on the rise. More and more of our customers are choosing bespoke asset finance solutions that not only allow them to spread the costs of their project over time, but also unlock powerful tax benefits.

For most organisations, the concept of leasing assets is a new one. However, once they realise that they can consolidate the cost of a project in one simple, affordable facility, the benefits and possibilities tend to take over.

For many, retaining the capital to deploy elsewhere is key, whilst for others recognising the benefits of funding growth in the same way as they manage their building (lease or mortgage) is more beneficial.

Financing your project can transform how you think about your business strategy. Imagine being able to pay a low, fixed amount each month and in return have exactly what you need to succeed today and in the future.

Locking capital away in depreciating assets is no longer necessary. Free up cash to be deployed elsewhere, working harder for your organisation and delivering true returns.

Make investment decisions based on your needs and not limited by constrained budgets which might otherwise restrict what you can achieve.

Finance allows you to match your costs in line with the return on investment of your projects, minimising the risk to your business.

Combine all of your project costs, including fees, labour, and delivery charges into one low, fixed monthly payment.

For private sector organisations, finance provides a highly attractive, 100% tax deductible solution. Those that are subject to higher tax rates have even more to save.

Your payments are manageable, low, and fixed for the duration of the agreement, meaning no hidden surprises or exposure should interest rates rise in the future.

Finance leasing introduces a whole new way of thinking to your project. Perhaps you really want to unlock your company’s potential but are sceptical about a large upfront cost.

By financing your project, you can give your business the opportunity to grow without crippling cash flow. The indicative figures below give an idea of what spreading the cost of a project could look like for your budget.

*Figures are based upon a finance lease agreement. All figures indicative and subject to approval and VAT.

Initial consultancy

Bluestone will work with you to review and assess your financial strategy to ensure it continues to meet the changing requirements of your growing business.

Reactive solutions

By understanding your goals and ambitions, Bluestone can source finance to help accelerate those plans and spread the cost and risk of any investment in a manageable and budget-friendly way.

Review and assess

The Bluestone team will be available when your business evolves and when markets change to ensure your responses maximise opportunity and minimise any risk, giving you the confidence that you’re prepared for any eventuality. Your dedicated Bluestone account manager will maintain quarterly contact with you, taking a deeper delve into your plans annually. Even the best strategies need adapting to ensure they continue to deliver the most value to your business.